The EDCI has several value propositions for General Partners

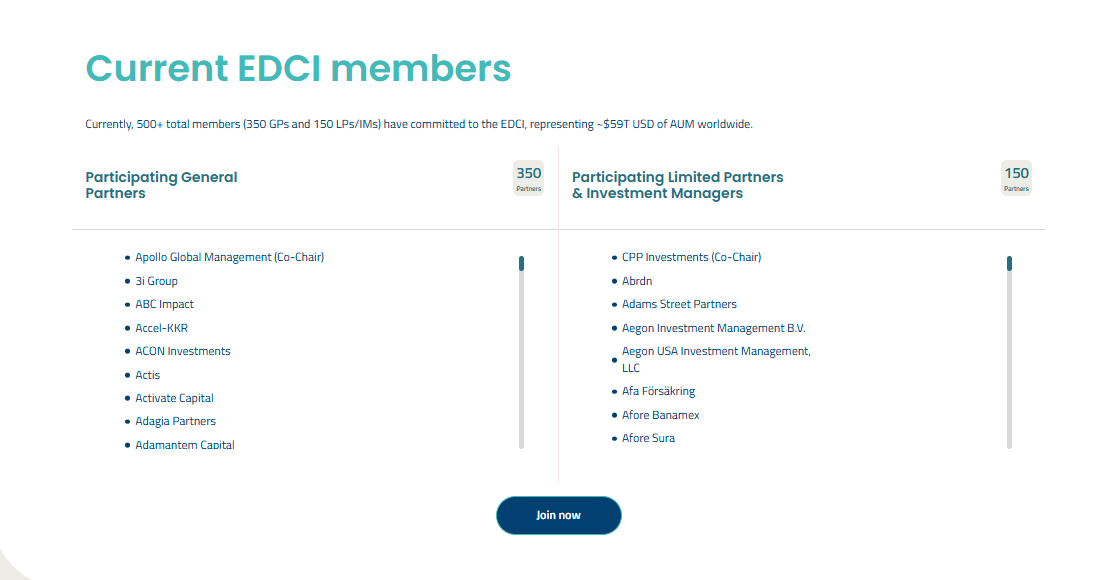

Our GP members are central in supporting our mission to advance convergence across the private markets, and generate useful, comparable, performance-based data.

For a full overview of GP membership, download the membership overview deck.

Every GP member of the EDCI benefits from the following value propositions:

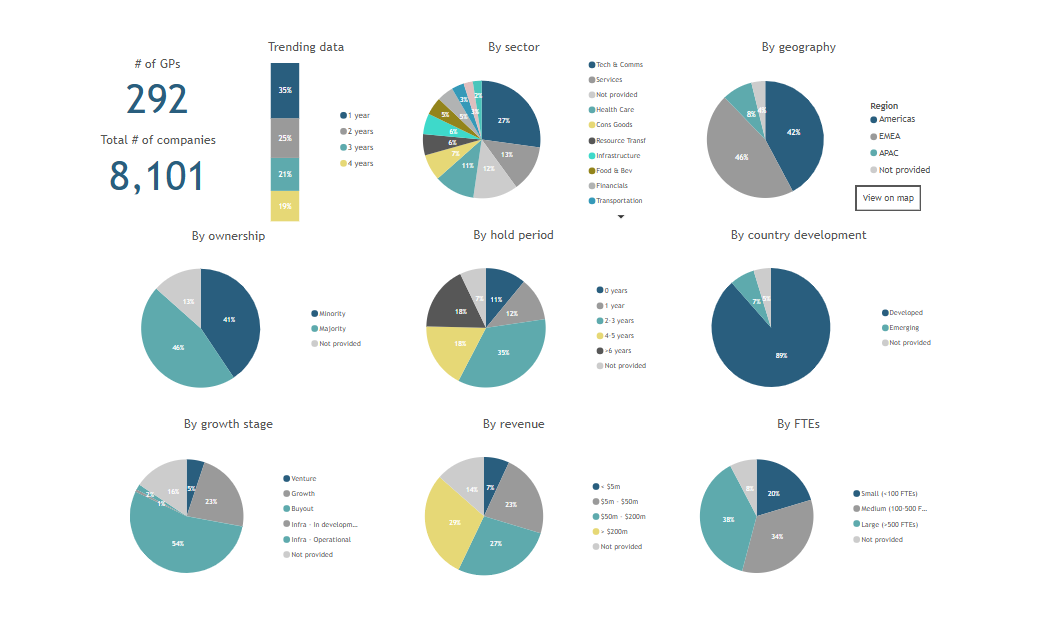

GP members can also unlock additional benefits through upgrading to the Analytics membership tier:

What does it mean for General Partners to be part of this initiative?

To participate, GPs agree to:

- Determine funds that will take part in the initiative (while we recognize GPs may start with a subset of their investment strategies, the expectation is this will increase over time, as feasible)

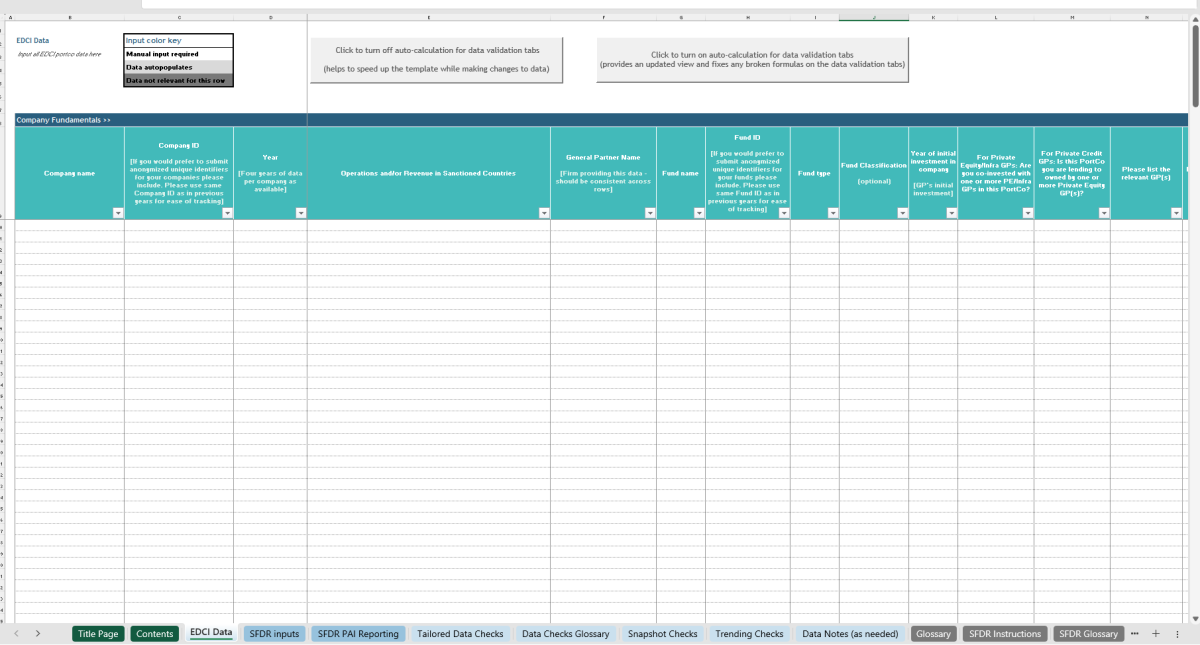

- On a best-efforts basis, track EDCI metrics, with an emphasis on core metrics

- Abide by the EDCI Metrics Guidance to the extent possible and explain deviations

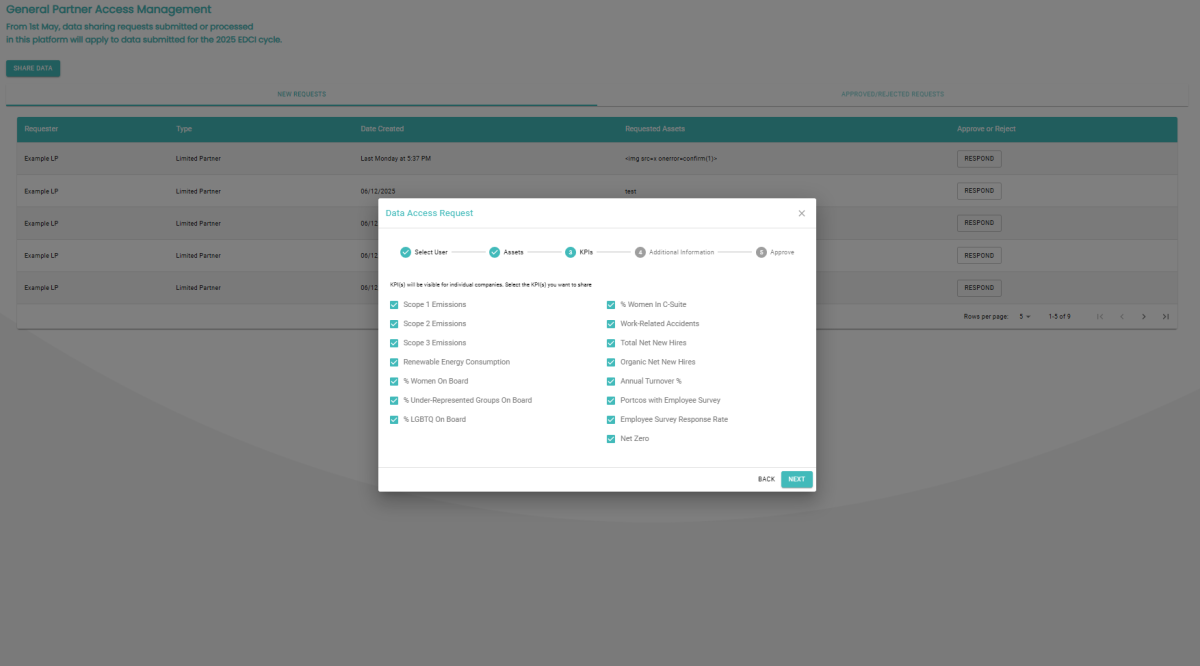

- As requested, provide EDCI data to LPs, preferably using the data sharing functionality on the EDCI portal, or related template

- Submit data to the EDCI for participating portfolio companies by April 30 each year

- Be publicly associated with the initiative

- Voluntary: serve on working groups or self-nominate to join the Steering Committee